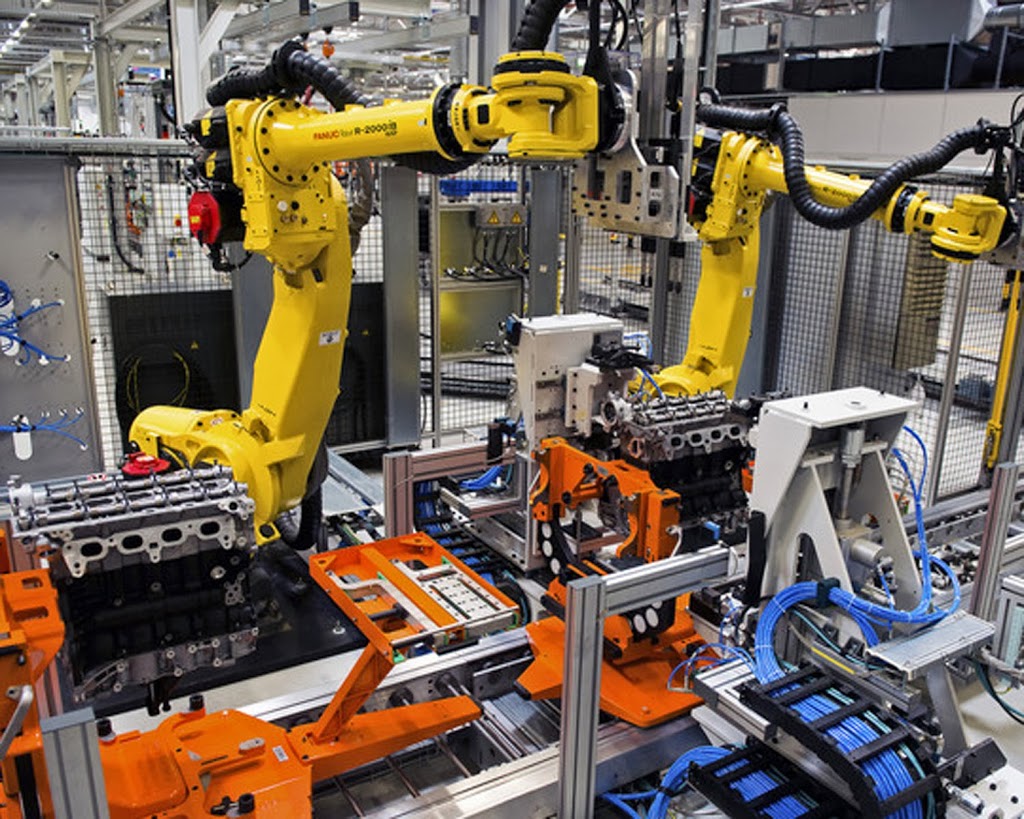

Robotics are an Integral Part of Manufacturing Processes

Taking both a short and long view, there’s no doubt that robotics is a key component of mainstream automated assembly in manufacturing processes today. The International Federation of Robotics (IFR) reported that 2012 saw the second highest number of robots ever sold: 159,346 units. IFR estimates the worldwide market value for robot systems at $26 billion in 2012.

About 70 percent of the total robot sales in 2012 went to Japan, China, the United States, Korea and Germany. That year, about 28,100 industrial robots were shipped to the Americas, 7 percent more than in 2011, a new high. Japan was again the biggest robot market in the world, with sales increasing slightly to 28,700 units. In the United States, robot shipments increased again by 9 percent in 2012 vs. 2011 to a new peak level of 22,414 units.

The automotive industry was the largest contributor to the continued increase in robot sales, accounting for about 40 percent. This represents a short-term trend. Since 2010, the automotive industry has increased investments in industrial robots worldwide. From 2006 to 2009, in contrast, installations declined each year. The United States ranked fourth in the automotive industry with a robot density of 1,091 units. In contrast, 76 units were installed in all other sectors per 10,000 employees.

According to IFR forecasts, robot installations are estimated to increase by 6 percent on average per year from 2014 to 2016, or about 4 percent in the Americas and in Europe and about 8 percent in Asia and Australia. The reason is an overall trend toward automation.

Generally, IFR points to several indicators that the robotics industry has a bright future:

- Global competition necessitates modernization of production facilities.

- Energy efficiency and new materials such as carbon composites require production retooling.

- Growing consumer markets are driving the expansion of production capacities.

- Decreasing product life cycles and increasing variety of products are requiring flexible automation.

- Technical improvements of industrial robots will increase the use of robots. Small and medium-sized companies will demand low-priced, easier-to-use robots for simple applications and allow collaboration with human workers.

- Improved quality standards are driving the need for sophisticated high-tech robot systems.

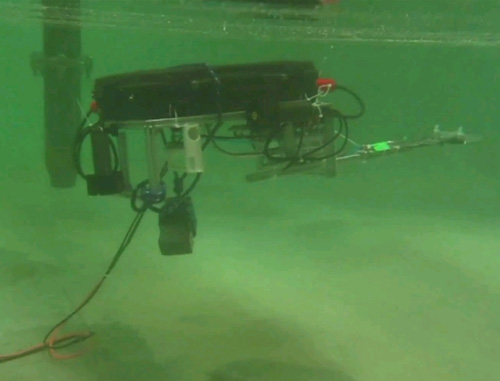

- Robots take over dangerous, tedious and dirty jobs that are not possible or safe for humans to perform.

RoboticsTrends.com, more current data obtained by IFR on Feb. 21, 2014. Global demand for industrial robots reached an all-time high in 2013, with sales of around 168,000 units. That figure represents a 5 percent increase over 2012.

Between 2010 and 2013, the average annual increase of robot sales globally was about 12 percent, despite weak economies in some key countries. Sales to the Americas continued to rise during 2013 due to the increasing automation of North American industry, while sales to Asia were driven by strong demand from China, South Korea and other emerging markets.

Between 2010 and 2013, the average annual increase of robot sales globally was about 12 percent, despite weak economies in some key countries. Sales to the Americas continued to rise during 2013 due to the increasing automation of North American industry, while sales to Asia were driven by strong demand from China, South Korea and other emerging markets.

In North America, the automotive industry continues to be the largest user of industrial robots, but demand in that sector did not increase during 2013. In contrast, shipments to non-automotive customers rose by 31 percent.

According to the Strategic Sourceror, more and more manufacturers are investing in robotic automation technologies or, at the very least, thinking seriously about it. The reason is that robotics isn’t just some cutting-edge, science fiction concept—global competition is making it a necessity rather than a luxury.

Twenty-first Century business doesn’t get any more mainstream than Google, Inc., Mountain View, CA. The New York Times recently reported that Google has acquired seven companies specializing in the production of robots. According to the newspaper, Google is planning to develop robotics tools for manufacturers, such as consumer electronics manufacturers that primarily operate manual assembly lines.

Robotics tools may also be able to help make distribution activities more efficient. Supply Chain Digest contributor Cliff Holste noted in a recent column that distribution centers really are not much different from manufacturing facilities, at least as far as robots are concerned, mainly due to the repetitive nature of the work. Holste notes that the European and Japanese markets have adopted robotics to a much greater extent than the United States. Another reason why robotics promises to become a more integral part of distribution centers is the need to ship high volumes of e-commerce orders.